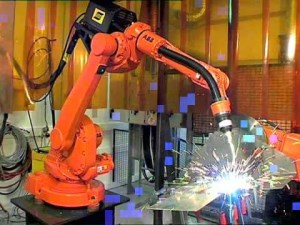

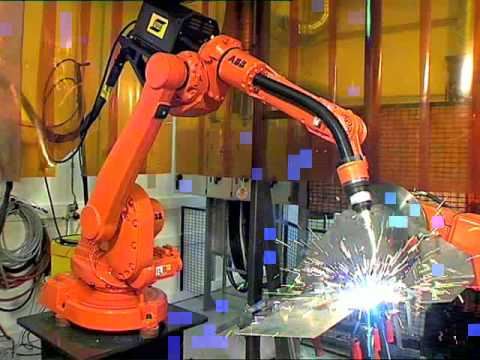

Industrial robotics giant ABB is accelerating expansion in China with a plan to double robot production capacity.

ABB has ambitious plans to be the biggest provider of the industrial-automation equipment worldwide, says Chief Executive Officer Ulrich Spiesshofer.

The blueprint includes doubling the number of robotics research employees in China, where a close rival Kuka AG – backed by Chinese appliances-maker Midea Group Co. – is seeking to unseat ABB’s lead in the $11 billion industry in the nation.

ABB also plans to seize on a growing industry in China for electric vehicles by supplying more charging facilities, says Mr Spiesshofer.

The push is part of ABB’s broader ambition to surpass Fanuc Corp. as the top global provider in robotics and automation.

The company is also aiming to take the lead in e-mobility infrastructure in China, which this month unveiled a decision to phase out combustion-engine cars.

The moves come as Mr Spiesshofer prepares to wrap up a four-year restructuring plan under which ABB regrouped operations and resisted investor pressure to break up its businesses to better realize shareholder value.

“ABB is ahead of Kuka globally, we are ahead of Kuka here in the market and our ambition is to stay so,” Mr Spiesshofer said in an interview in Shanghai earlier this month.

Zurich-based ABB also “absolutely” has the ability to be No. 1 in e-mobility infrastructure in China, the CEO said.

Mr Spiesshofer, who said he met with the mayor of Shanghai to discuss the company’s plan to boost robot production, didn’t provide a timeline or figures for the increase in capacity and research employees. ABB currently employs more than 17,000 people in 139 Chinese cities.

China Automation

China is installing more robots than any other nation as its vast manufacturing industry increases automation to move up the value chain.

The country added about 90,000 robots last year, a third of the global total, and this will rise to 160,000 in 2019, figures from the International Federation of Robotics show. The government wants domestic robot makers to have half of the market by 2020, according to Bloomberg Intelligence.

ABB is willing to provide technology and other forms of support to its local partners to help them become strong players in their own right, Spiesshofer said. More than 80 percent of the robots ABB sells in China are “developed, produced and shipped” in the nation, he said.

The recent decision by China, the world’s biggest auto market, to determine a timetable to end sales of vehicles powered by fossil fuels in line with a global trend provides another growth opportunity.

Mr Spiesshofer said ABB is working with regional governments on pilot projects for charging facilities in places like public carparks, where it’s more common for drivers in China to leave their cars than in private garages.

EV Charging

As many as 800,000 charging stations will be built this year alone, according to the official China Daily. ABB has the manufacturing capacity in place to support that pace, Mr Spiesshofer said.

Charging stations are part of ABB’s electrification products division, which contributed $9.9 billion in revenue last year, or about 29 percent of the company’s total. The robotics and motion business, which includes robots as well as motors and drives, accounted for $7.9 billion, or about 23 percent.

These are among four new divisions, the other two being industrial automation and power grids, that ABB regrouped into after Mr Spiesshofer resisted a call – led by its second-largest shareholder, Swedish activist investor Cevian Capital AB – to break up the company. It also placed the power grids business under review and promised to cut costs to boost profitability.

“That page is turned and we are moving into the future,” the CEO said.

He said organic growth would be the company’s focus, with acquisitions a secondary possibility. In April, it paid $2 billion for Austrian company Bernecker & Rainer Industrie-Elektronik GmbH to help the company move away from its traditional hardware business and expand in higher-margin software.

Major acquisition

This week ABB announced the acquisition of GE Industrial Solutions, GE’s global electrification solutions business for $2.6 billion (A$3.28 billion).

In 2016, GE Industrial Solutions had revenues of approximately $2.7 billion, with an operational earnings before interest, tax, depreciation and amortisation (EBITDA) margin of approximately eight per cent and an operational EBITA margin of approximately six per cent.

The transaction will be operationally accretive in year one.

ABB expects to realise approximately $200 million of annual cost synergies in year five, which will be key in bringing GE Industrial Solutions to peer performance. As part of the transaction and overall value creation, ABB and GE have agreed to establish a long-term, strategic supply relationship for GE Industrial Solutions products and ABB products that GE sources today.

“With GE Industrial Solutions, we strengthen our Number two position in electrification globally and expand our access to the attractive North American market,” said Mr Spiesshofer.

Unique global portfolio

GE Industrial Solutions will be integrated into ABB’s Electrification Products (EP) division, resulting in a unique global portfolio and very comprehensive offering for North American and global customers.

ABB’s EP division delivers more than 1.5 million products to customers around the world every day through a global network of channel partners and end-customers. EP offers a comprehensive portfolio of low- and medium-voltage products and solutions for a smarter, more reliable flow of electricity from substation to socket.

Mr Spiesshofer said ABB’s restructuring efforts would be completed this year, after the company’s unclear identity led it to move in a “convoluted” direction when he started as CEO four years ago.

“Today we have a crisp, clear identity. We know for what we stand,” Mr Spiesshofer said.

“2018 will be the first year of what I call the new normal. It will be then steady-state sailing.”

Source: Bloomberg News