The collaborative robotics market is booming as more businesses discover the many benefits of these high-tech helpers.

A new analysis from global tech market advisory firm, ABI Research, predicts the yearly revenue for cobot arms will reach US$11.8 billion by 2030.

That’s nearly 30 percent of the total industrial robot market.

It’s also a huge increase from the US$711 million which is expected to be reached this year.

And when you add software-related revenues and end-of-arm tooling (EOAT) accessories, the total value of the collaborative market is considerably more.

With these inclusions, the cobot ecosystem is worth just over US$1 billion this year and will be worth US$24 billion by 2030, with a CAGR of 28.6%.

“The prospects for the collaborative robotics market remain strong, despite some very visible inhibitors,” says Rian Whitton, Senior Analyst at ABI Research.

“The hardware innovation is still trailing behind, and most of the value related to cobots does not come from collaboration,” he says. “It comes through ease-of-use, re-programmability, lower total cost compared to industrial systems, and re-deployability. In essence, the value is one of lowering barriers rather than building entirely new use-cases for robots.

“What is more, cobots still trail industrial systems in speed, performance, and payload, which will have to change if adoption is to continue at this feverish rate.”

Strong growth ahead

Currently, the cobot market as a percentage of the industrial market is very small.

In terms of revenue, all revenue from cobot arms is 5% of industrial robot hardware, but that will increase to 29% by 2030, ABI Research predicts.

This growth is not just related to adoption, but also to the increasing convergence between the two sub-groups.

Through advances in sensors, machine vision, and motion control, industrial robots will increasingly take on the benefits of collaborative systems. The value prospect for software innovation is strong too, growing from US$558 million in 2020 to US$10.6 billion in 2030.

Most of this value will be attributed to analytics, perception, motion control, and operations-related software.

Market leader

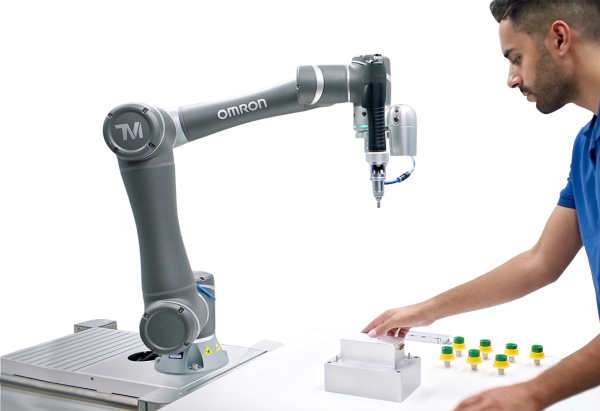

With 59% of global cobot shipments in 2018, Universal Robots is the clear market leader.

They have managed to achieve relevance for screw-driving applications in the auto industry, attracting the business of big US car manufacturers and component suppliers.

Also, many smaller companies are now using cobots for pick & place and machine tending applications.

The manufacturing sector is rapidly deploying cobots to provide more flexibility and customisation.

Cobots are also being increasingly used for last-minute orders and for high-volume, low-mix automation projects.

Not a complete panacea

ABI Research notes that cobots do not provide a complete panacea but are an important step in the direction of a leaner and more flexible workplace.

“Collaborative Systems are not revolutionising the industry so much as being the catalyst for a leaner and more flexible industrial robotic solution that opens the field up to small and medium manufacturers,” says Whitton.

“As the demands of customisation and high-mix, low-volume manufacturing present managers with new challenges, this technological development will be crucial in transitioning to a more adaptable solution.”

These findings are from ABI Research’s Industrial Collaborative Robots Market Tracker market data report.

Source: ABI Research